Compatible with all major banking platforms

Let your customers pay online, or directly with no-code payment links

Let your customers pay online, or directly

with no-code payment links

Super for Ecommerce

• For businesses that sell directly online. • Integrations with all major ecommerce platforms + custom. • Low-friction & high-security.

No-code Payment Links

• For businesses without an ecommerce website. • Create a link and share anywhere and to anyone. • No code required, simply create via your Business Portal.

No-code Payment Links

• For businesses without ecommerce. • Create a link and share anywhere • No code required, simply create via your Business Portal.

No-code Payment Links

• For businesses without ecommerce. • Create a link and share anywhere. • No code required, simply create via your Business Portal.

The Super Payments platform enables free payments alongside improved settlement, refunds, fraud detection and an optimised user experience.

Super Payments

Card Payments

Transaction Fee

FREE

Optional: You can pass on some savings as Cash Rewards to your customer

1-5%

Settlement

Paid daily

1-3 days

Customer refunds

Instant and free

7-14 days

Fraud detection

Strong

Weak

Checkout process

3 steps

Up to 9 steps

Super Payments

Card Payments

Transaction Fee

FREE

Optional: You can pass on some savings as Cash Rewards to your customer

1-5%

Settlement

Paid daily

1-3 days

Customer refunds

Instant and free

7-14 days

Fraud detection

Strong

Weak

Checkout process

3 steps

Up to 9 steps

Super Payments

Transaction Fee

FREE

Optional: You can pass on some savings as Cash Rewards to your customer

Settlement

Paid daily

1-3 days

Customer refunds

Instant and free

Fraud detection

Strong

Checkout process

3 steps

Card Payments

Transaction Fee

1-5%

Settlement

Customer refunds

7-14 days

Fraud detection

Weak

Checkout process

Up to 9 steps

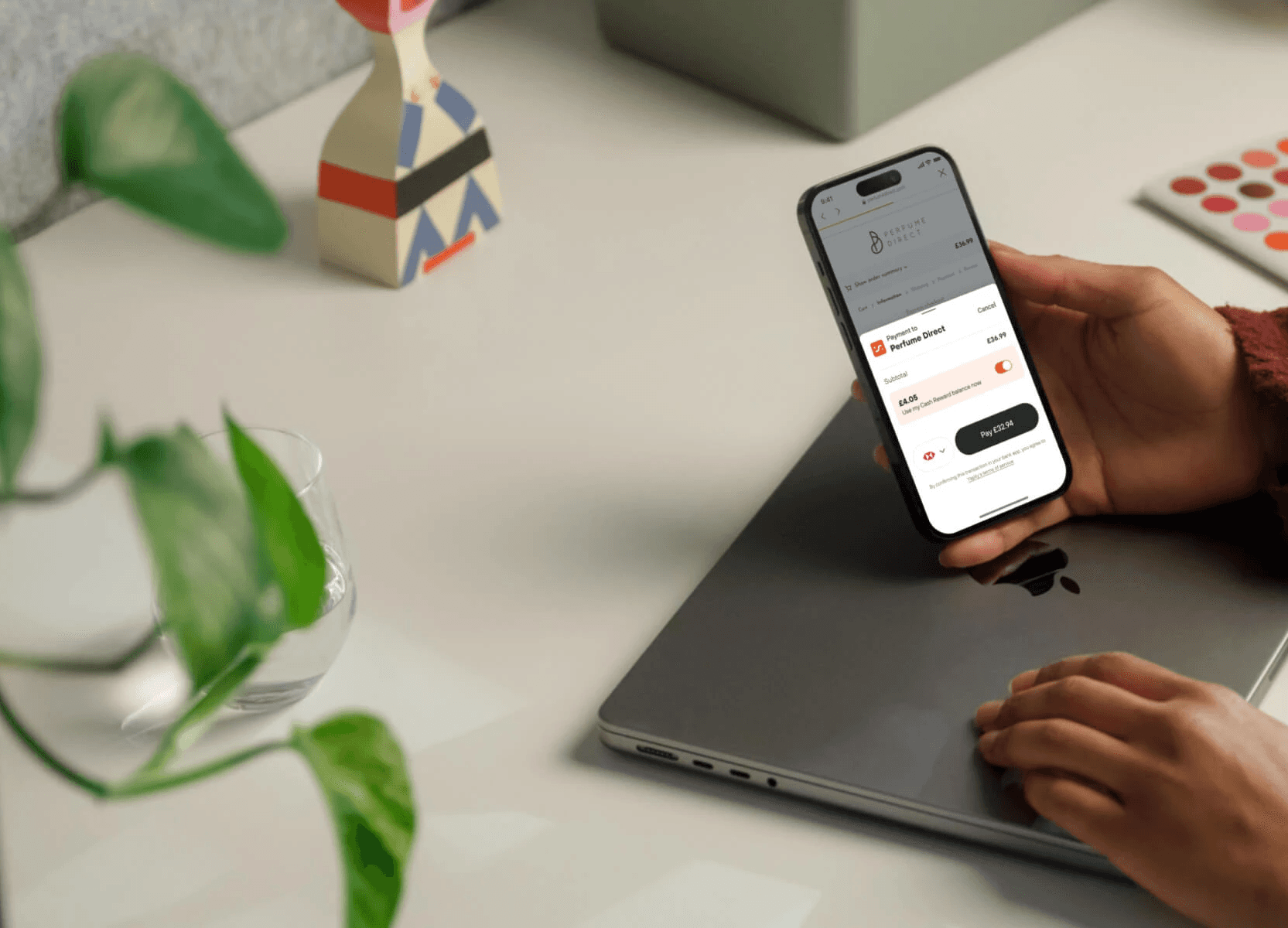

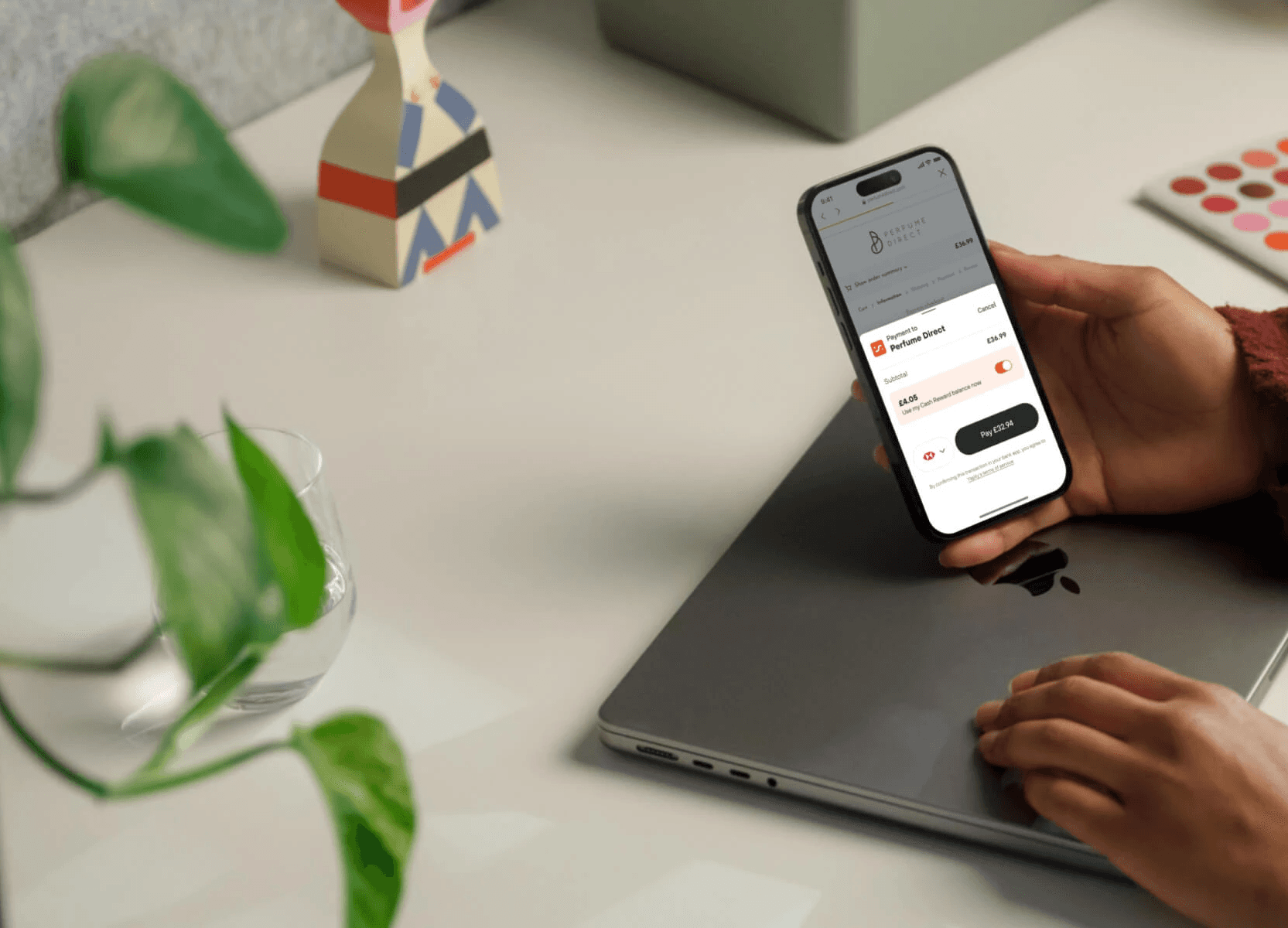

Super's Payment Platform

Our platform enables businesses to accept real-time, account-to-account payments directly from your customer's bank account when they are checking out on your website. Over 70 million bank accounts in the UK are supported by Super.

Super's Payment Platform

Our platform enables businesses to accept real-time, account-to-account payments directly from your customer's bank account when they are checking out on your website. Over 70 million bank accounts in the UK are supported by Super.

Super's Payment Platform

Our platform enables businesses to accept real-time, account-to-account payments directly from your customer's bank account when they are checking out on your website. Over 70 million bank accounts in the UK are supported by Super.

The benefits of open banking

Fast & Easy Payments for Customers

Super allows customers to make payments effortlessly using fingerprint or face ID.

Cost savings

You pay no payment processing fees - they are subsidised by Super.

Fraud protection

Commonly found fraud risks, like CNP, are eliminated with Super

No chargebacks

No costly and drawn-out chargeback, associated with traditional payment methods

Super Payments offers businesses free payments, forever

Get started with Super Payments today and help your business grow.

Super Payments offers businesses free payments, forever

Get started with Super Payments today and help your business grow.

Super Payments offers businesses free payments, forever

Get started with Super Payments today and help your business grow.

FAQ

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?

Copyright 2025 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Copyright 2025 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.