No more card fees.

0% payment fees

0% payment fees

Acquire new customers, on your terms

Acquire new customers, on your terms

Retain customers & increase sales

Retain customers & increase sales

500,000

UK shoppers (and growing)

1,000+

UK retailers use Super

1.3x

Super members shop more

A radically better payment company

Super powers free payments for businesses and more rewarding shopping for customers, so that everyone wins.

As featured in

Super & Not so Super

0% transaction fees across credit and debit cards

Consumer UK Visa

& Mastercard

Consumer UK Visa

& Mastercard

& Google Pay

Apple Pay

UK corporate cards

UK pay by bank

EU cards

Time to receive money

Time to

receive money

0%

0%

0%

0%

0%

Next day

Other Providers

Other Providers

1.2% + 30p

1.2% + 30p

1.2% + 30p

1.2% + 30p

2.9% + 30p

2.9% + 30p

1.2% + 30p

1.2% + 30p

2.49% + 30p

2.49% + 30p

2-3 days

2 days

Super offers a range of optional paid add-ons that can be switched on and off at any time. Certain non-standard payments are subject to additional fees.

See for yourself how much you could save

Fraudulent payments?

Not on our watch.

Alongside hundreds of default fraud prevention rules, Super Payments uses machine learning and AI-driven insights to uncover complex fraud patterns, helping keep your business safe.

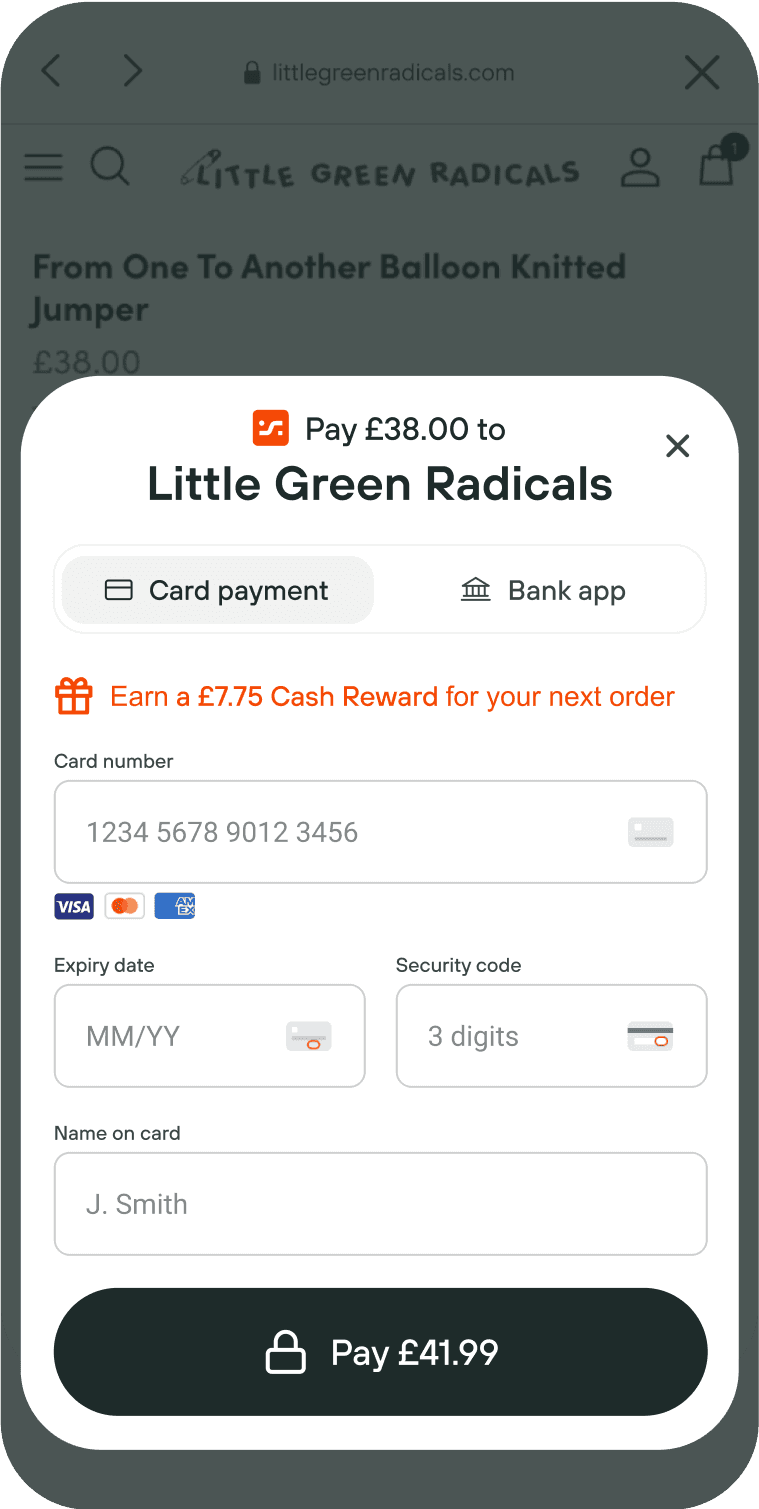

Accept card payments for free

0% payment fees

Best-in-class user experience

Industry-leading fraud protection

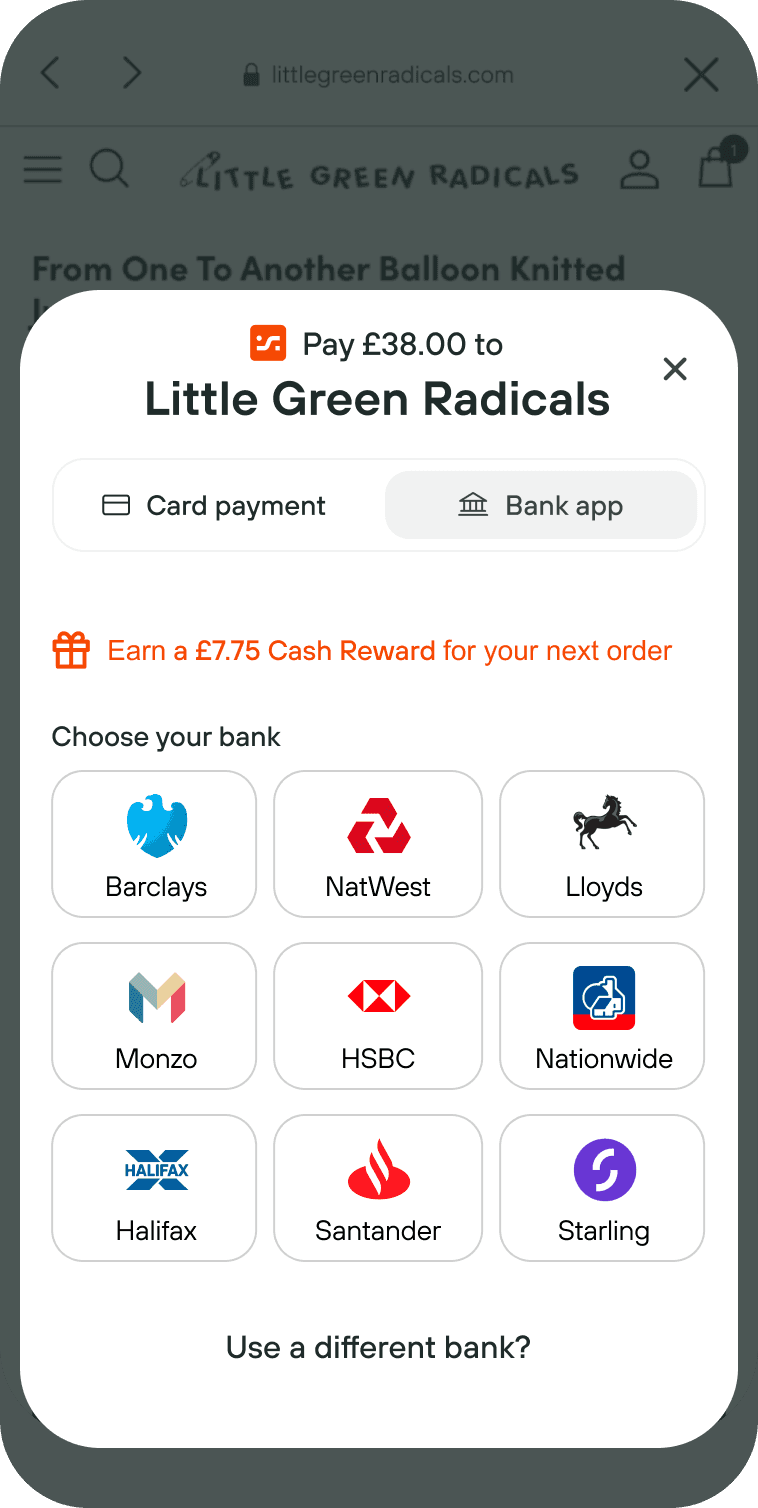

Accept open banking payments for free

0% payment fees

Smooth & Fast: three-tap checkout

Confirmed securely via customer's bank app

Confirmed securely via

customer's bank app

Super &

Not so Super

0% transaction fees across credit and debit cards

Super

Visa & Mastercard

0%

1.2% + 30p

UK corporate cards

0%

2.9% + 30p

UK pay by bank

0%

1.2% + 30p

EU cards

0%

2.49% + 30p

Time to receive money

7 days

Next day

Super

0% processing

UK pay by bank

Buy Now Pay Later

0%

EU Cards

0%

0% processing

Time to

receive money

Next day

Other Providers

1.2% + 30p

1.2% + 30p

Buy Now Pay Later

UK pay by bank

1.2% + 30p

5%

EU cards

2.49% + 30p

Time to

receive money

2 days

0% processing

Optional Super add-ons

Super offers a range of paid add-ons that can be switched on and off at any time.

Daily Payouts

Receive settled funds fast.

Card payments: Mon - Fri.

Open Banking: Mon - Sun.

Instant Payouts

All settled and unsettled funds paid within minutes. Available 24/7.

Add Amex

Cash Advance

Fast & flexible business funding

£29.99 per month

0.99% fee

2.85% fee

up to 25% of your annual turnover

Read more: Super's Business Pricing

Super offers a range of optional paid add-ons that can be switched on and off at any time. Certain non-standard payments are subject to additional fees.

Compatible with all major banking platforms

Fraudulent payments?

Not on our watch.

Alongside hundreds of default fraud prevention rules, Super+ Fraud Prevention uses machine learning and AI-driven insights to uncover complex fraud patterns, helping to keep your business safe.

Acquisition with

Super is simple

Super

Only pay for true

customer interactions

They benefit from a

proportion of your spend

No upfront

ad spend

Full control over

Cost-Per-Click (CPC)

Basket size

control

Ad creation process

Set and forget:

60 seconds

&

Only pay for true

customer sales

Pay per click, or

per impression

They benefit from a

proportion of your spend

100% of investment

to advertiser

No upfront

ad spend

Billing required

Full control over Cost

Per Acquisition (CPA)

Can't guarantee

cost efficiency

Basket size

control

Limited value control

Ad creation process

Complex & lengthy

Super

Only pay for true

customer interactions

They benefit from a

proportion of your spend

No upfront

ad spend

Full control over

Cost-Per-Click (CPC)

Basket size

control

Ad creation process

Set and forget:

60 seconds

&

Only pay for true

customer sales

Pay per click, or

per impression

They benefit from a

proportion of your spend

100% of investment

to advertiser

No upfront

ad spend

Billing required

Full control over Cost

Per Acquisition (CPA)

Can't guarantee

cost efficiency

Basket size

control

Limited value control

Ad creation process

Complex & lengthy

Acquire new customers

We will bring you new customers from the Super network of shoppers. You only pay if they make a purchase on your website.

Maintain full control over your Cost Per Acquisition (CPA), with a proportion given to the new customer towards their first purchase.

Acquisition with Super is simple

Only pay for true

customer sales

Customers benefit from a

proportion of your spend

No upfront ad spend

Full control over Cost

Per Acquisition (CPA)

Basket size control

Ad creation process

Time to

receive money

Set and forget:

60 seconds

Set and forget:

60 seconds

Pay per click, or

per impression

Pay per click, or

per impression

100% of investment

to Google

100% of investment

to Google

Billing required

Billing required

Google can't guarantee

cost efficiency

Google can't guarantee

cost efficiency

Limited value control

Limited value control

Complex & lengthy

Complex & lengthy

Pay per click, or

per impression

Pay per click, or

per impression

100% of investment

to Meta

100% of investment

to Meta

Billing required

Billing required

Meta can't guarantee

cost efficiency

Meta can't guarantee

cost efficiency

Limited value control

Limited value control

Complex & lengthy

Complex & lengthy

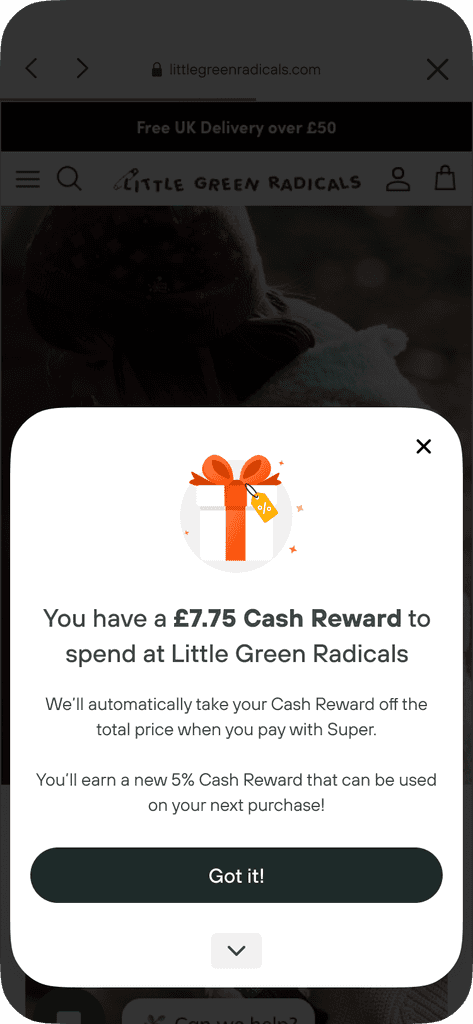

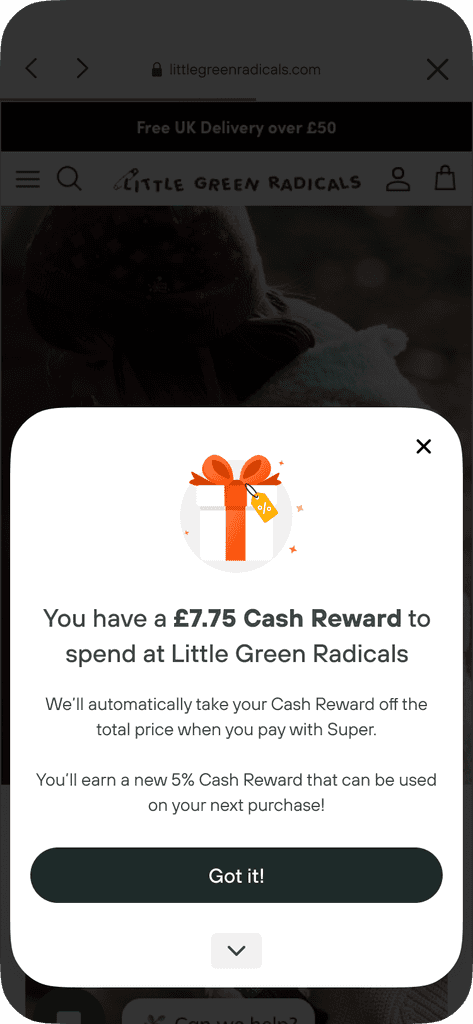

Retain: your customers will shop 1.3x more

Offering Cash Rewards to your customers with every Super payment encourages repeat purchases. These rewards are exclusive to your store and Super members typically buy 1.3 times more. If they don't return, you pay nothing.

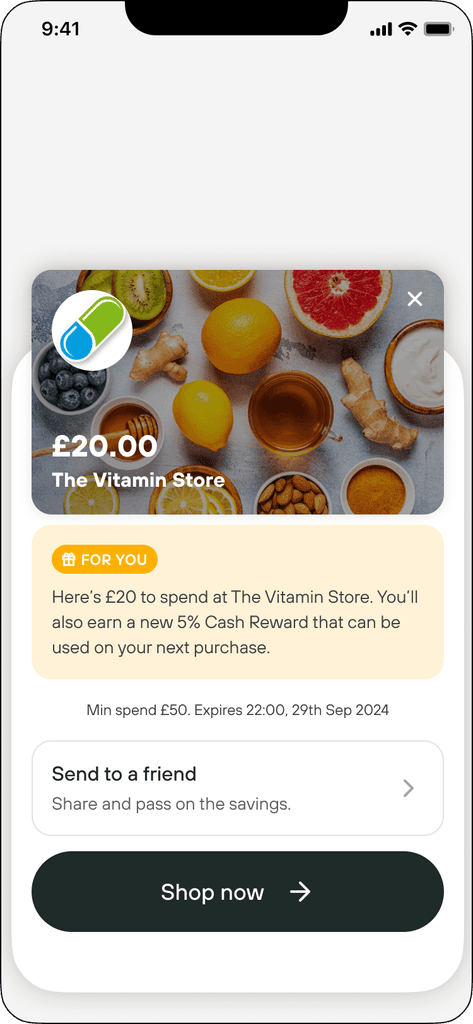

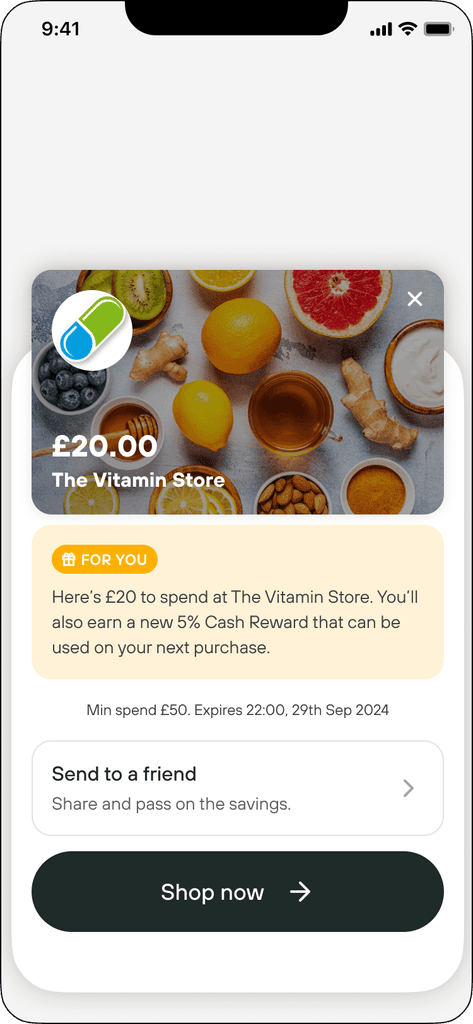

Get free visibility for your business from 500,000 UK consumers

Businesses that offer Cash Rewards are featured in the Super app, used by 500,000 UK customers. Get free visibility for your business.

Get free visibility for your business from 500,000 UK consumers

Businesses that offer Cash Rewards are featured in the Super app, used by 500,000 UK customers. Get free visibility for your business.

Super is integrated with all major ecommerce platforms

The Super API caters for custom ecommerce integrations. We will support your business in getting up and running with dedicated tech support.

Enterprise grade partnerships and security

Enterprise grade partnerships and security

Enterprise grade partnerships and security

Our team has delivered a seamless, secure, scalable platform that puts both merchant and consumer at the centre of everything we do.

FAQ

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?

Copyright 2025 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Payments Limited (FRN:1034245), trading as www.superpayments.com is an Introducer Appointed Representative of Frasers Group Financial Services Limited (FRN: 311908) who are authorised and regulated by the Financial Conduct Authority as a credit lender. Frasers Plus is a credit product provided by Frasers Group Financial Services Limited and is subject to your financial circumstances. For regulated payment services, Frasers Group Financial Services Limited is a payment agent of Transact Payments Limited, a company authorised and regulated by the Gibraltar Financial Services Commission as an electronic money institution. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Copyright 2025 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Payments Limited (FRN:1034245), trading as www.superpayments.com is an Introducer Appointed Representative of Frasers Group Financial Services Limited (FRN: 311908) who are authorised and regulated by the Financial Conduct Authority as a credit lender. Frasers Plus is a credit product provided by Frasers Group Financial Services Limited and is subject to your financial circumstances. For regulated payment services, Frasers Group Financial Services Limited is a payment agent of Transact Payments Limited, a company authorised and regulated by the Gibraltar Financial Services Commission as an electronic money institution. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.