Card payments are old news.

Say hello to Super Payments.

40%

Businesses using Cash Rewards typically see a 40% increase in repeat purchases. That's more of your valued customers returning to you.

Daily

All sales are settled instantly, then paid daily to your bank account. This alleviates cashflow concerns and means you can focus on growth.

Free

The only payment partner offering 0% fees to all businesses, forever.

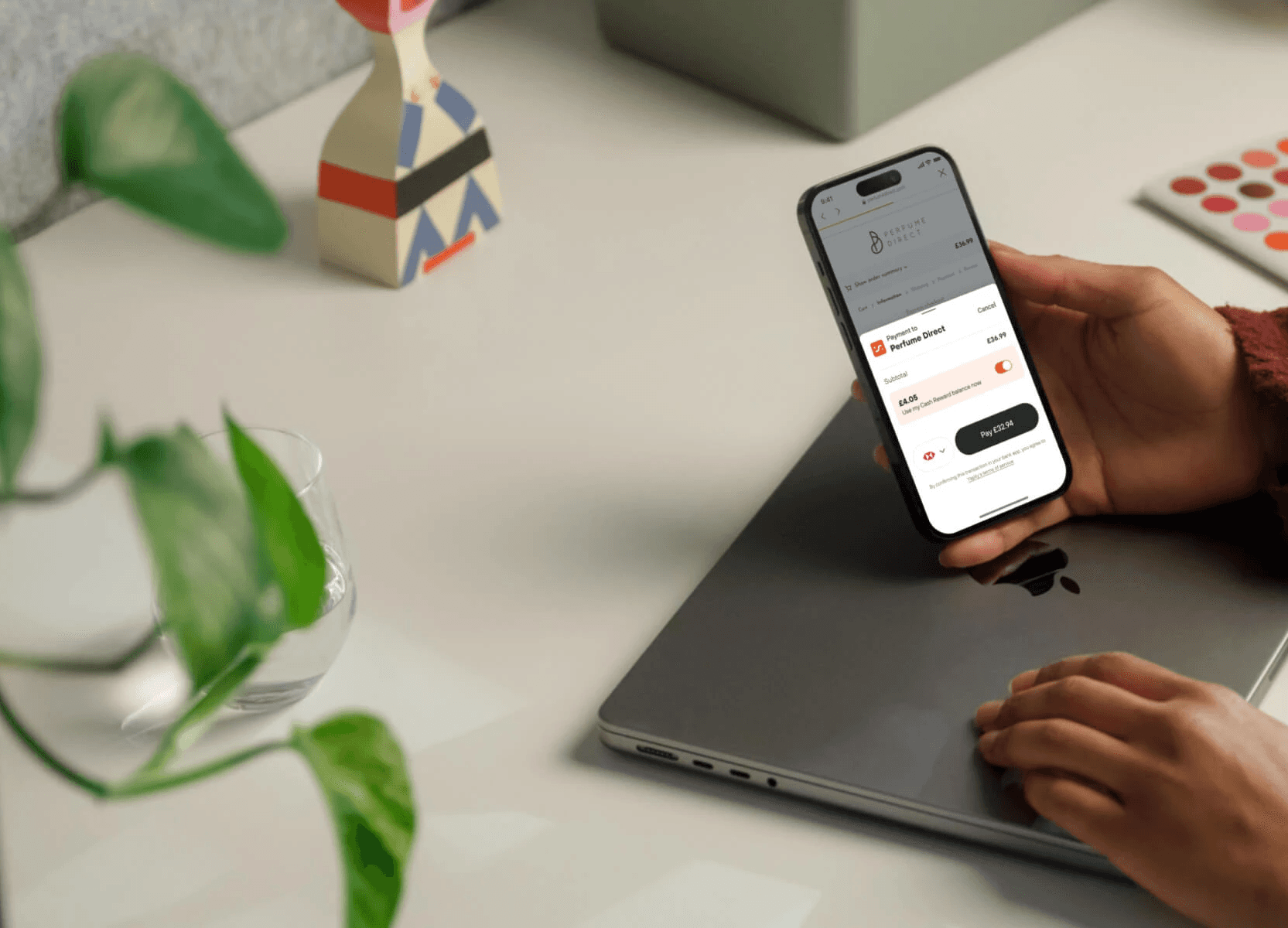

Payments, Super-charged

Free Payments, forever.

Acquire and retain customers.

Instant settlements and refunds.

No subscription or hidden costs.

Ecommerce & payment links supported.

Safe & secure with high fraud detection.

Payment technology built for your business needs

If your store doesn’t run on these platforms, Super offers an API for custom integrations and can support your business in getting up and running with dedicated tech support.

Grow

Drive conversion, retention and customer lifetime value with Cash Rewards.

Acquire more customers

More reasons to buy from you.

Trigger repeat purchases

Increase purchase frequency by 40%.

Increase AOV

Cash Rewards drive higher basket value.

Super members typically make 40% more repeat purchases.

The Benefits of Cash Rewards

How do cash rewards work?

Save

Join dozens of stores who are saving money every day by taking payments through Super.

Free

The world’s only free payment provider.

Fast

Instant settlements - paid daily.

Cost-effective

Free refunds, no chargebacks.

Compatible with all major banking platforms

The Super Payments platform enables free payments alongside improved settlement, refunds, fraud detection and an optimised user experience.

1. Limited to first 10 merchants within the UK who sign up by 5pm on 29th March 2024.

2. Offer will run for the first 10 merchants who apply, for three months from the start of the offer going live.

3. This offer is only applicable for merchants who are new to Super Payments.

4. The offer must be redeemed in full, by the merchant, by Friday 28th June 2024.

FAQ

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?