Welcome to the 0% Club.

0% Pay Later fees

0% Card processing fees (incl. Apple & Google Pay)

0% Open Banking fees

This is why we think you'll like us:

Super Payments offers Pay Later (via Super Credit), Open Banking, and traditional card payments (including Apple Pay and Google Pay).

Every other provider charges a processing fee, but we are the only one that has removed it entirely. Open Banking and Super Credit are completely free for businesses.

For card payments, you only pay the mandatory Visa/Mastercard and bank fees and nothing extra.

Card payments.

Card payments.

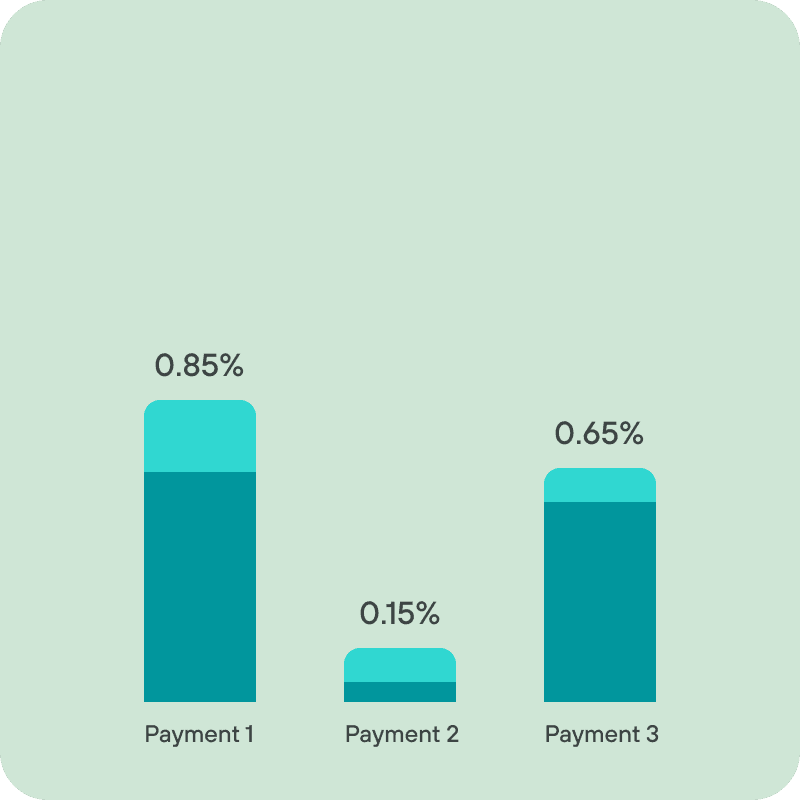

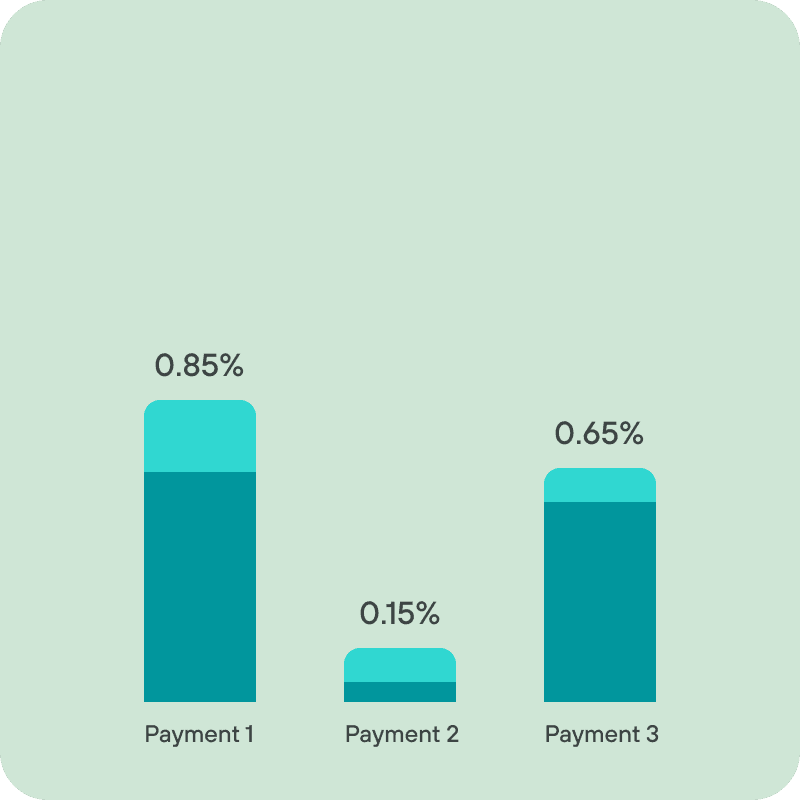

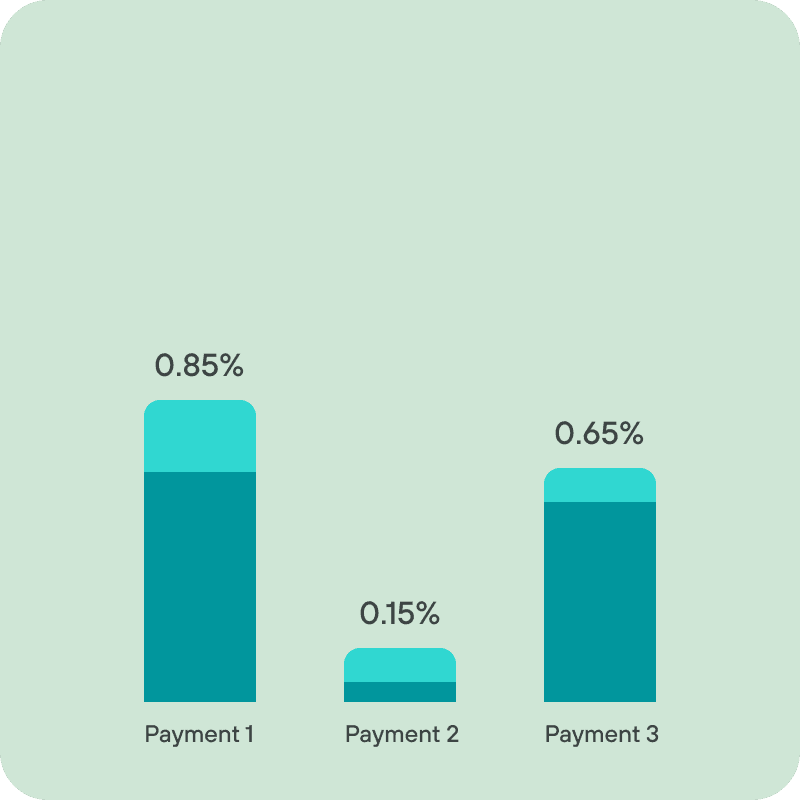

Normally, card transaction fees have unavoidable mandated costs (interchange and scheme) plus processor markups. Interchange for UK consumer transactions is usually 0.2% to 0.3%, paid to the cardholder’s bank. Scheme fees go to Visa and Mastercard and shift over time. Processor fees are simply the extra charges added by payment providers.

Super Payments Pricing:

We never add processor markups or hide costs in blended or “plus” models. By passing on only interchange + scheme, we offer the lowest, most transparent pricing in the market and are always cheaper than providers that add a markup:

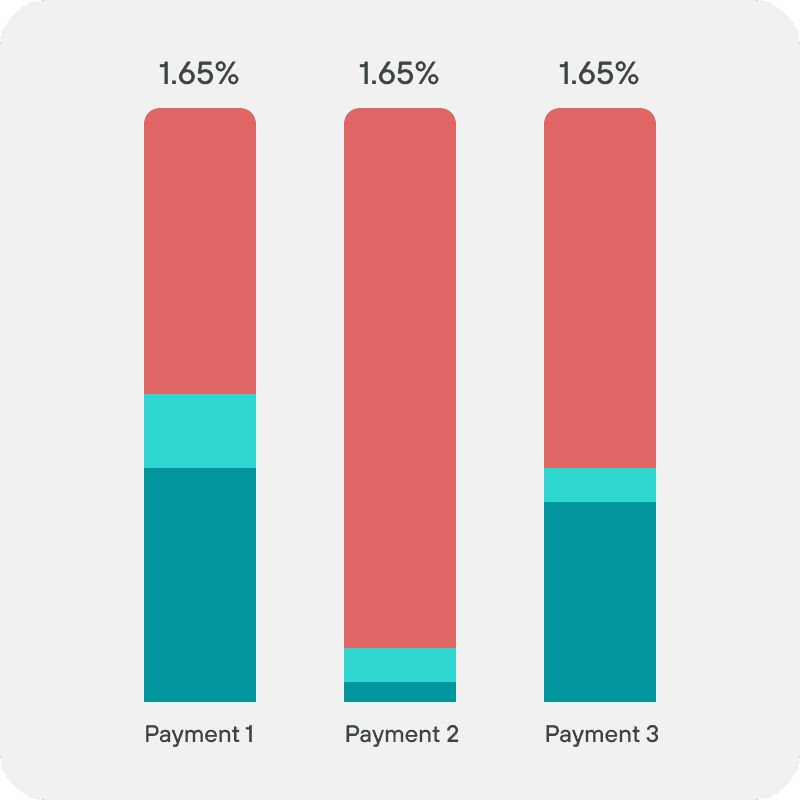

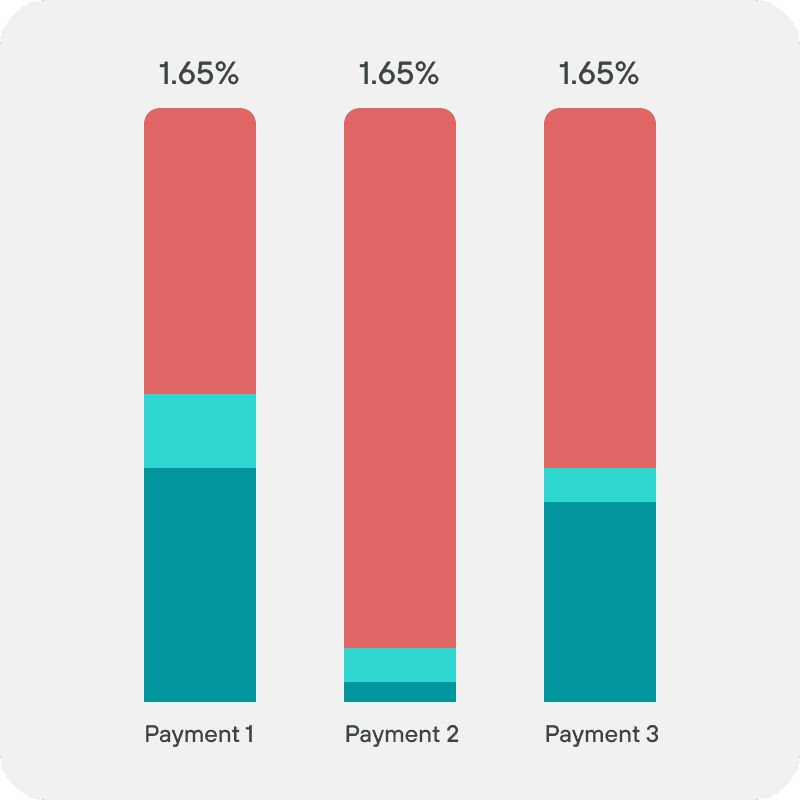

Blend Pricing.

Blend Pricing.

One flat rate (e.g. 1.65%) for all transactions.

One flat rate (e.g. 1.65%) for all transactions.

Simple and predictable.

Simple and predictable.

Often overpriced, since you pay the same high markup fee even on cheap debit card transactions.

Often overpriced, since you pay the same high markup fee even on cheap debit card transactions.

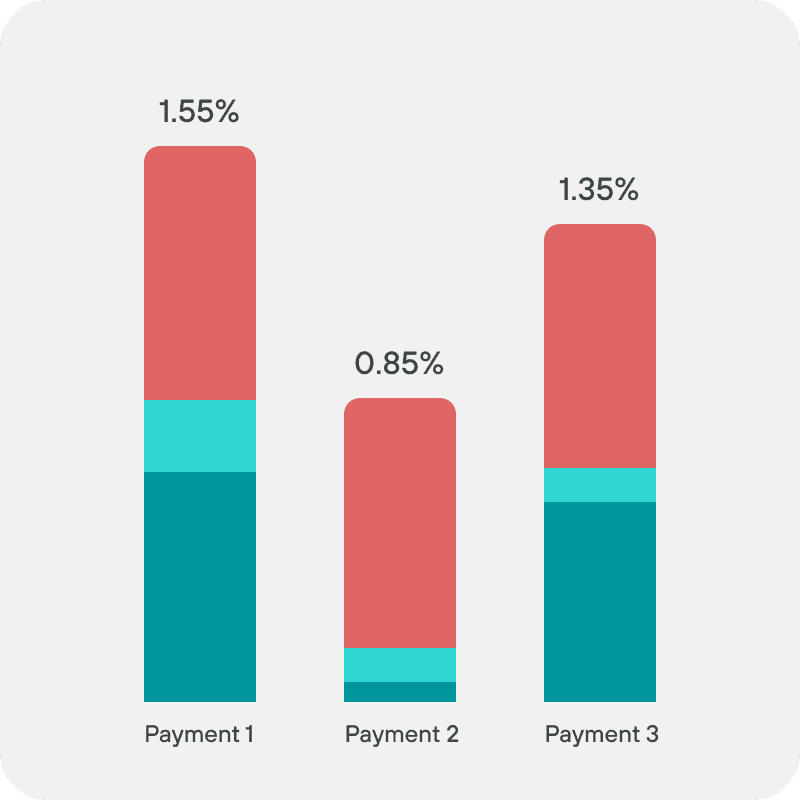

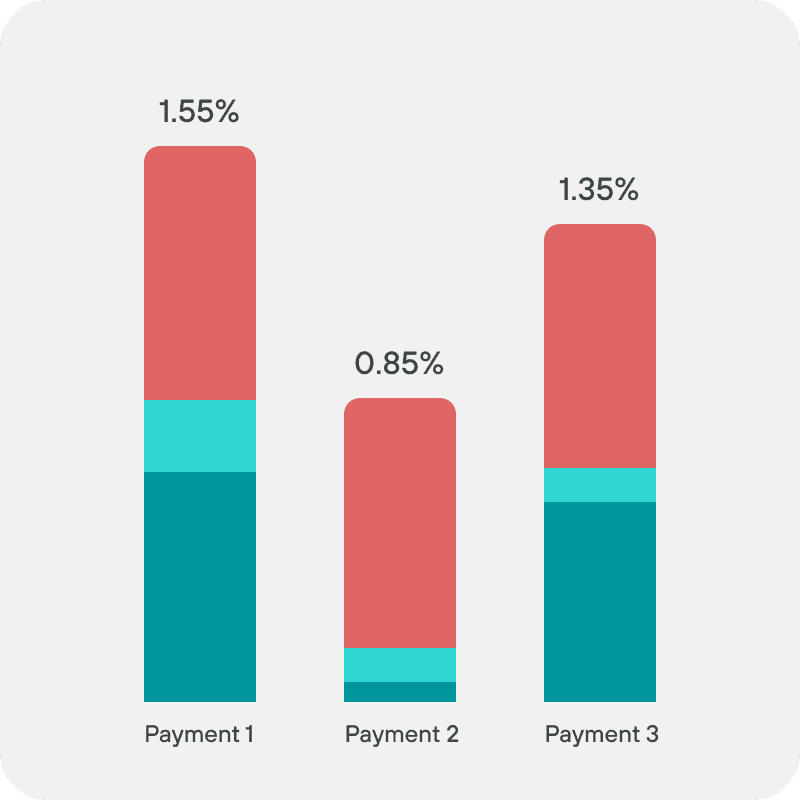

Interchange++ Pricing.

Interchange++ Pricing.

Fee split into interchange + scheme + processor margin.

Fee split into interchange + scheme + processor margin.

More transparent and fairer than blended.

More transparent and fairer than blended.

Costs vary by card type, and providers still add their own markup.

Costs vary by card type, and providers still add their own markup.

Super Payments Pricing.

Super Payments Pricing.

Only unavoidable card costs (interchange + scheme).

Only unavoidable card costs (interchange + scheme).

No processor markup → lowest possible pricing.

No processor markup → lowest possible pricing.

100% transparent.

100% transparent.

Welcome to the 0% Club.

0% Pay Later fees

0% Card processing fees (incl. Apple & Google Pay)

0% Open Banking fees

This is why we think you'll like us:

Super Payments offers Pay Later (via Super Credit), Open Banking, and traditional card payments (including Apple Pay and Google Pay).

Every other provider charges a processing fee, but we are the only one that has removed it entirely. Open Banking and Super Credit are completely free for businesses.

For card payments, you only pay the mandatory Visa/Mastercard and bank fees and nothing extra.

Card payments.

Normally, card transaction fees have unavoidable mandated costs (interchange and scheme) plus processor markups. Interchange for UK consumer transactions is usually 0.2% to 0.3%, paid to the cardholder’s bank. Scheme fees go to Visa and Mastercard and shift over time. Processor fees are simply the extra charges added by payment providers.

Super Payments Pricing:

We never add processor markups or hide costs in blended or “plus” models. By passing on only interchange + scheme, we offer the lowest, most transparent pricing in the market and are always cheaper than providers that add a markup:

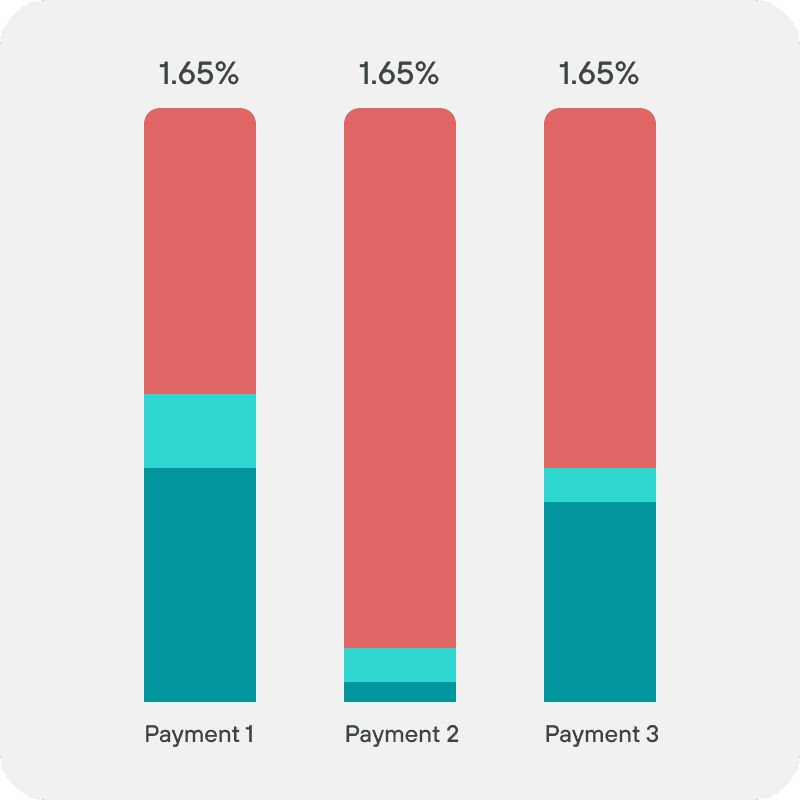

Blend Pricing.

One flat rate (e.g. 1.65%) for all transactions.

Simple and predictable.

Often overpriced, since you pay the same high markup fee even on cheap debit card transactions.

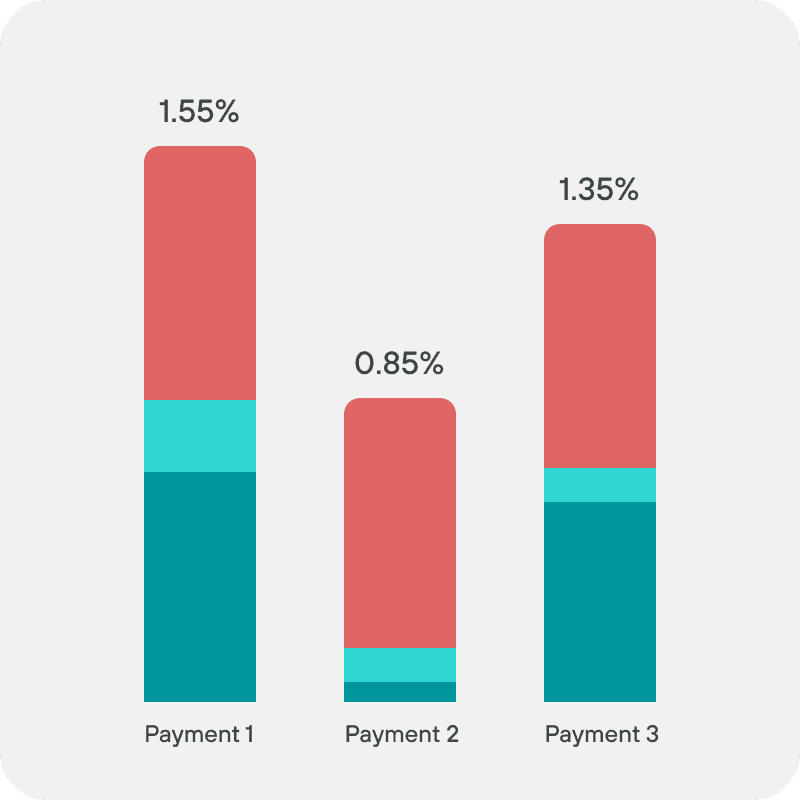

Interchange++ Pricing.

Fee split into interchange + scheme + processor margin.

More transparent and fairer than blended.

Costs vary by card type, and providers still add their own markup.

Super Payments Pricing.

Only unavoidable card costs (interchange + scheme).

No processor markup → lowest possible pricing.

100% transparent.

Copyright 2026 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Copyright 2026 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Copyright 2026 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.