Products

About

Blog

The latest news and updates.

Governance

The Aave Governance forum.

Products

About

Blog

The latest news and updates.

Governance

The Aave Governance forum.

Sell More,

Pay Nothing.

Pay Later, Card Processing, and Open Banking all with 0% fees.

Pay Later, Card Processing, and Open Banking all with 0% fees.

£0

Spent on payment fees

£0

Spent on fees

£0

Spent on payment fees

A checkout experience your customers will love.

A checkout experience your customers will love.

A checkout experience your customers will love.

How Super offers 0% fees while enhancing your customer experience.

Read more

Super removes payment processing costs, and uses other ways to make money. As a result, your processing stays free and your checkout frictionless for your customers.

Commission from lenders

Super Credit is always free for businesses, Super is paid a commission by lenders for every purchase.

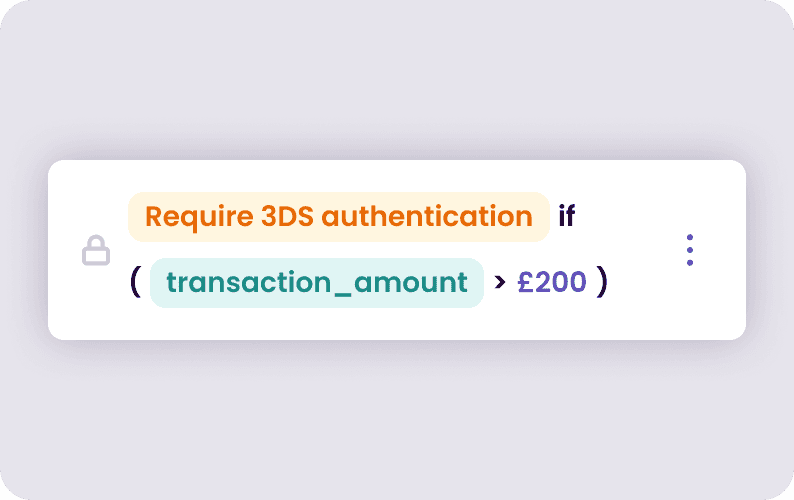

Paid add-ons

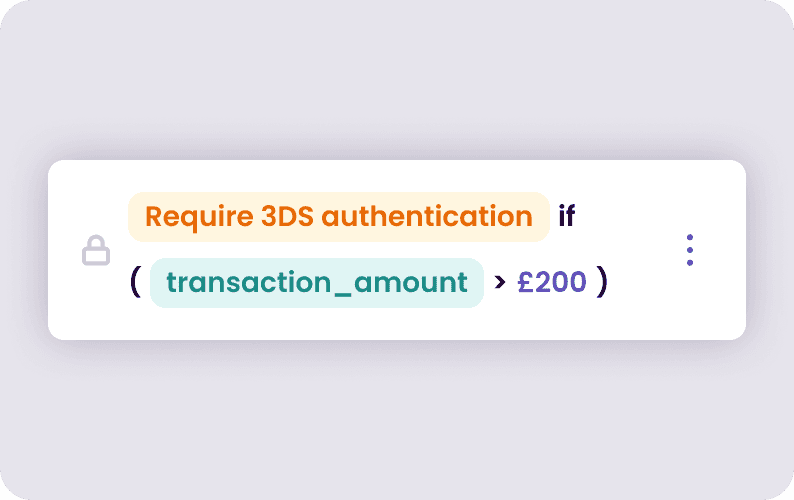

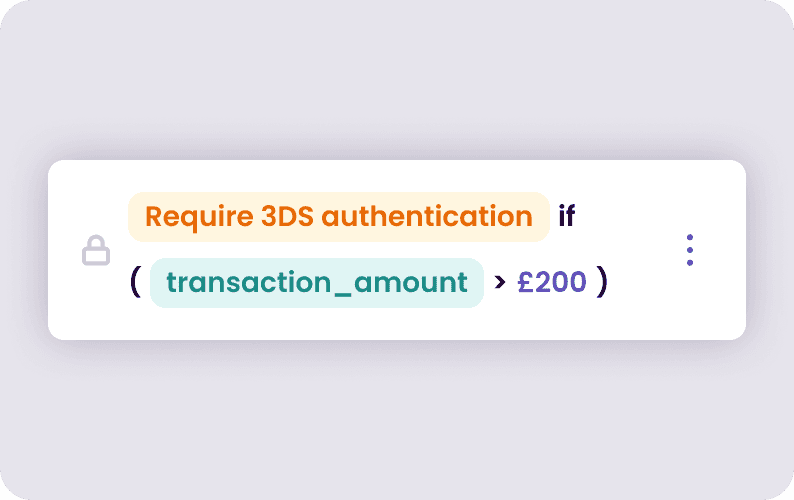

For an additional cost, merchants can access more payment functionality, such as advanced fraud controls.

Read more

More rewards for them, zero fees for you.

Pay the way you want

Pay the way you want

We support card, bank app, Apple/Google Pay and instalment options

We support card, bank app, Apple/Google Pay and instalment options

Fast & Secure

Fast & Secure

No eternal loading screens or dropping in and out of your baskets.

No eternal loading screens or dropping in and out of your baskets.

More rewarding shopping

More rewarding shopping

A little bonus for them with every purchase made with you

A little bonus for them with every purchase made with you

All the ways to pay.

0% processing.

No tiers, minimums, or surprise fees

All the ways to pay.

0% processing.

No tiers, minimums, or surprise fees

"Fee-freeprocessingrepresentsasignificantannualsavingforourbusiness—thesefundscannowbereinvestedintoserviceandfurtherexpansion."

"Fee-freeprocessingrepresentsasignificantannualsavingforourbusiness—thesefundscannowbereinvestedintoserviceandfurtherexpansion."

"Fee-freeprocessingrepresentsasignificantannualsavingforourbusiness—thesefundscannowbereinvestedintoserviceandfurtherexpansion."

Ready to find out more?

There’s so much more to talk about.

From savings and steering to the nitty gritty statement breakdowns, we’ve got you covered.

There’s so much more to talk about.

From savings and steering to the nitty gritty statement breakdowns, we’ve got you covered.

Integration, simplified.

Super API

Built with that ‘not like everybody else’s’ custom set up in mind

All major platforms

Sameday seamless integration for your provider

Dedicated support

No need to sit around worrying what’s going on, we’ll keep you in the loop.

Read documentation

More than just a platform.

More than just a platform.

Fraud protection.

Fraud protection.

You’re in safe hands with Super. We comply with the highest standards of all relevant payment regulations.

Payment add-ons.

Payment add-ons.

Increase your payment coverage with paid add-ons like Amex and corporate cards.

Drive growth with offers.

Drive growth with offers.

Drive growth by reaching new customers when they’re in a buying mindset, all through Super Offers.

FAQ.

How does Super make money if payments are free?

What are Cash Rewards?

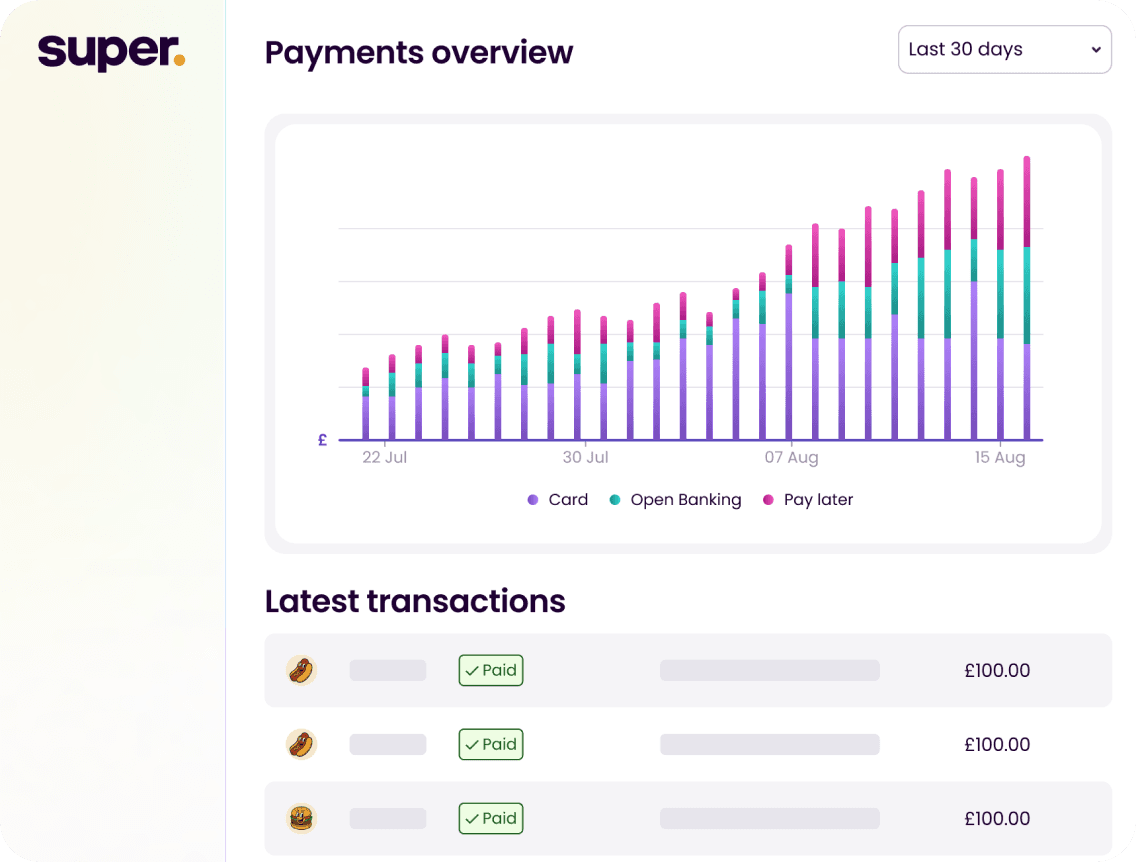

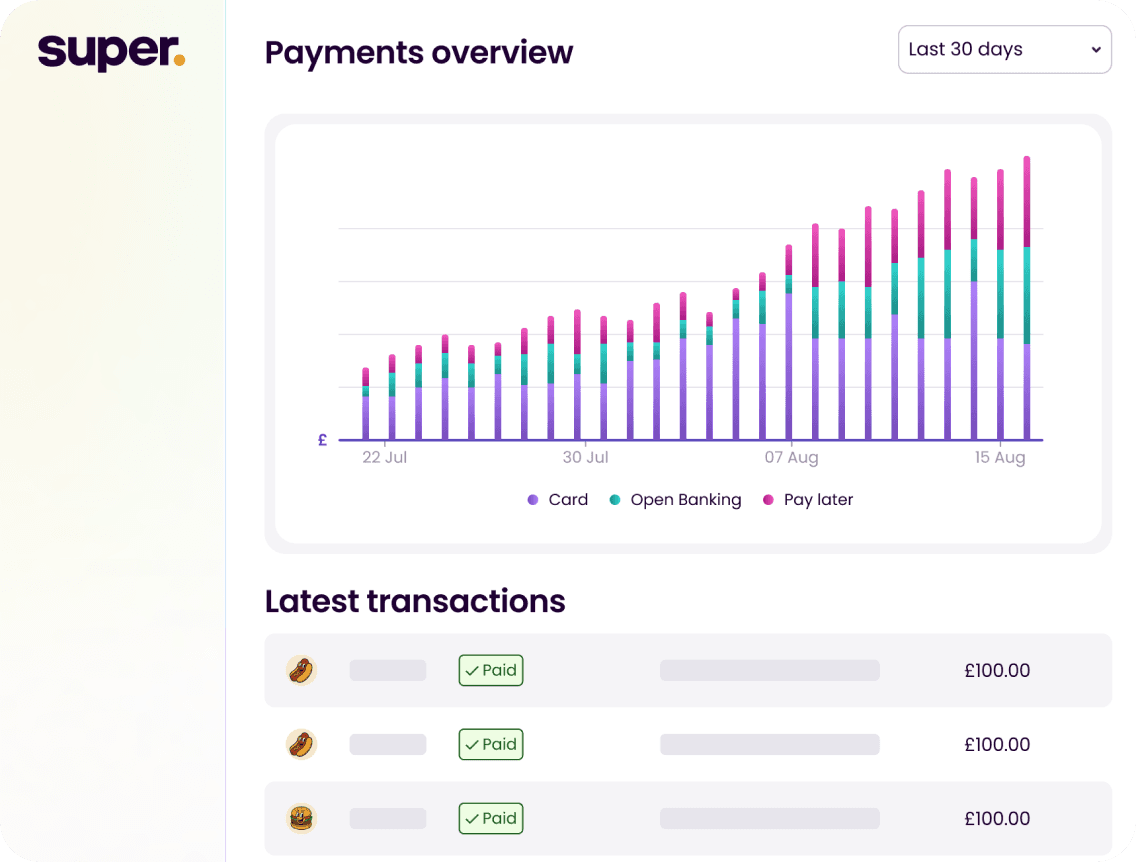

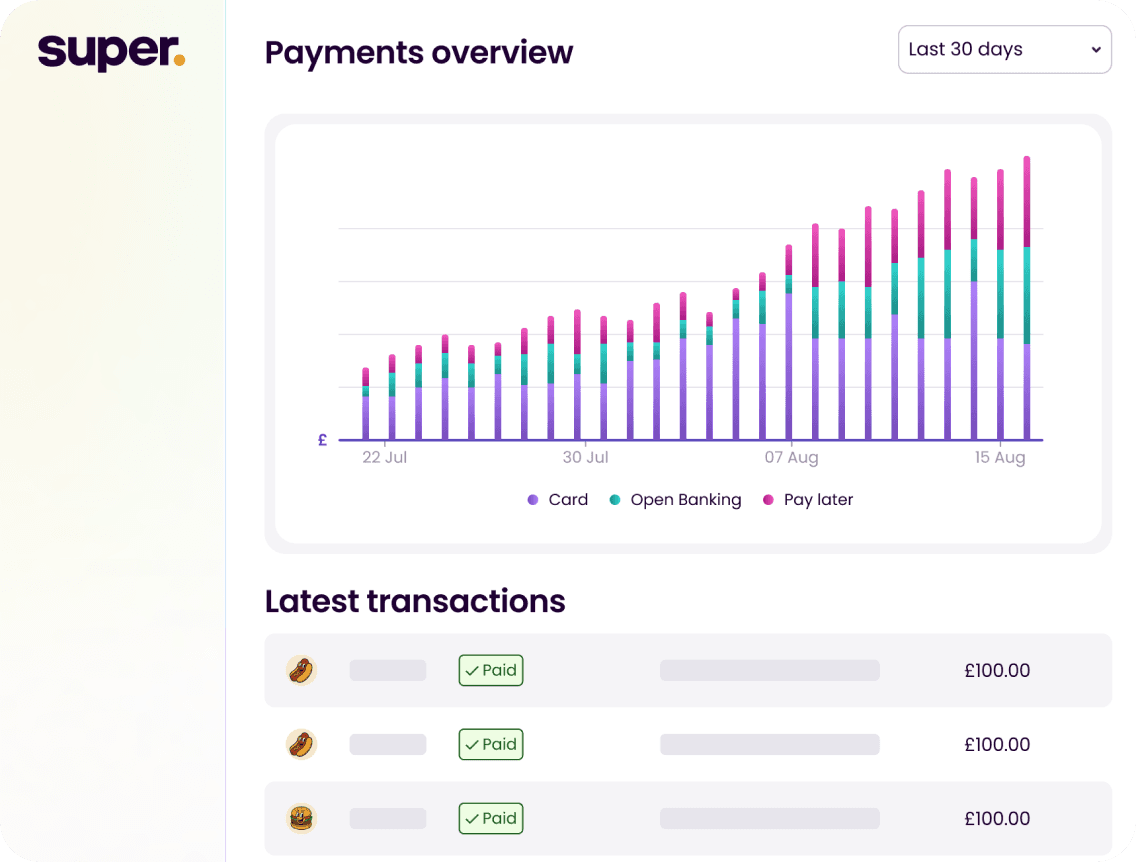

How do I track payments?

How easy is it to integrate?

Is there a contract?

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?

How does Super make money if payments are free?

What are Cash Rewards?

How do I track payments?

How easy is it to integrate?

Is there a contract?

Copyright 2026 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Copyright 2026 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.

Copyright 2026 Super Payments. All rights reserved.

Super Payments Limited is a private limited company with company number 13903817. Open banking payments are powered by Yapily Connect Limited and Modulr FS Limited. Yapily Connect Limited is authorised and regulated by the UK Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference 827001). Super Payments Limited is a distributor of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your business account and related payment services are provided by Modulr FS Limited. Super Payments Information Security Policy is available on request. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS), business funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 - more information. Card payments and business accounts are powered by Stripe Payments UK Limited. Stripe UK Payments Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference: 900461) as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services.

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply. Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE. Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions. Missed payments may affect your credit score.

Business address at 123 Buckingham Palace Road, London, SW1W 9SH.